![Having fun - tycoon Jho Low on a regular jaunt with Paris Hilton]()

Having fun on Malaysia’s development budget? Tycoon Jho Low at a regular jaunt with Paris Hilton

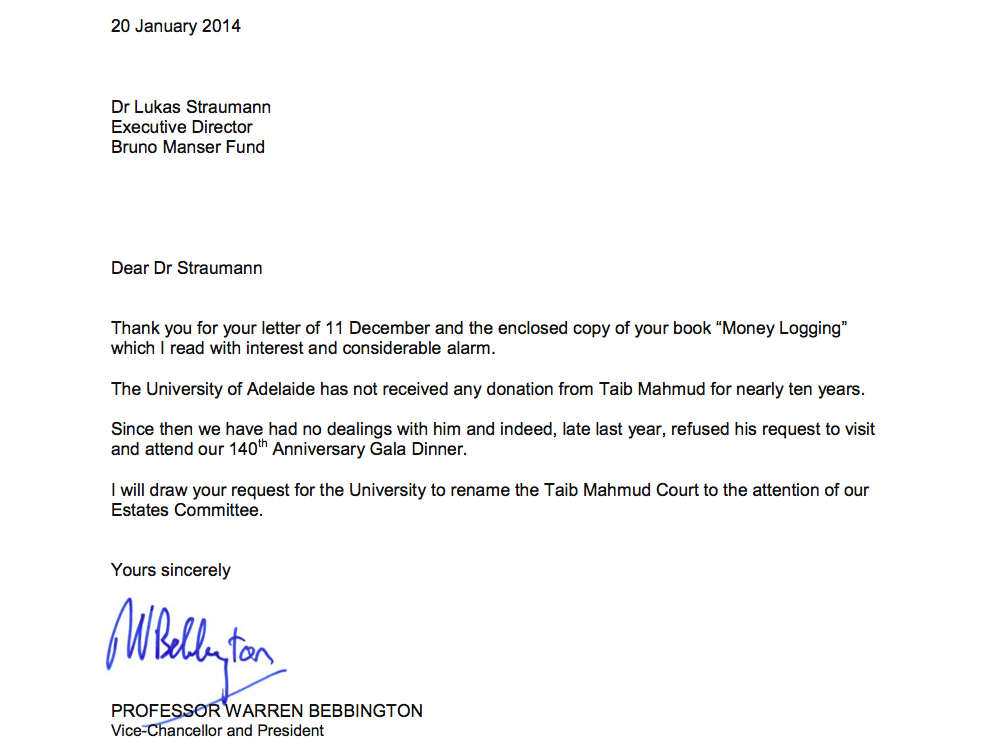

Together with London’s Sunday Times newspaper, Sarawak Report has completed an in-depth investigation into the trail of the missing billions at the heart of Malaysia’s 1MDB (One Malaysia Development Berhad) financial scandal.

We have obtained access to thousands of documents and emails relating to transactions by 1MDB, including its initial joint venture with the little known oil company PetroSaudi International from 2009.

What the documents establish is that, in spite of copious official denials, the entire joint venture project was conceived, managed and driven through by the Prime Minister’s associate and family friend the party-loving billionaire tycoon, Jho Low.

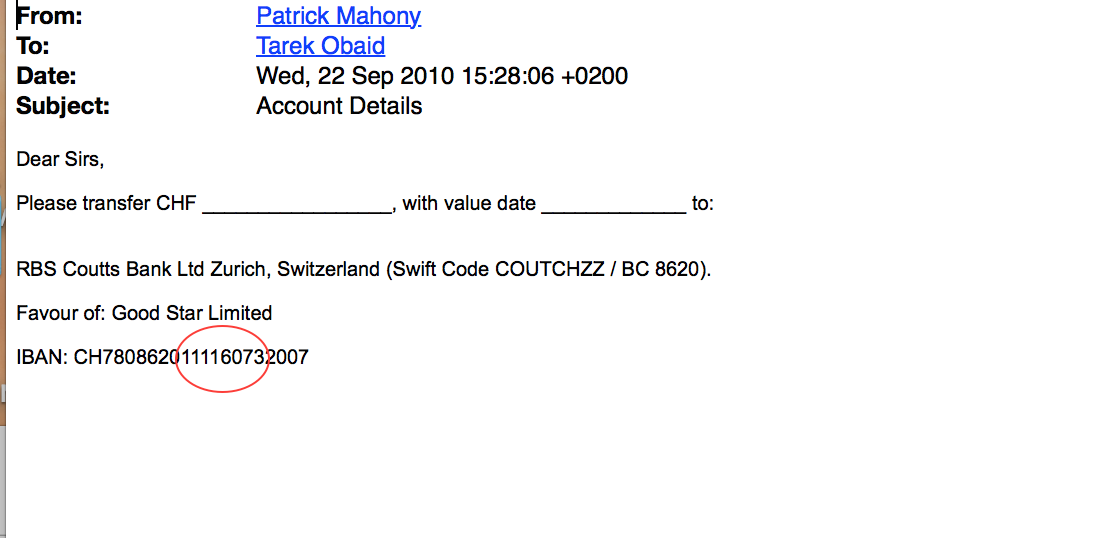

The documents also prove that the USD$700 million so-called “loan” that was supposedly repaid to PetroSaudi as part of the joint venture agreement, was in fact directed into the Swiss bank account of a company called Good Star, which is controlled by Jho Low.

That money was then partly used to buy out Taib Mahmud’s UBG bank in Sarawak at a very advantageous price for the chief minister and his family, who had been failing to get a deal on the open market.

PetroSaudi had agreed to act as “a front” for Jho Low on such deals, according to the documents, and it was a subsidiary of PetroSaudi International registered in the Seychelles, which bought UBG, using money siphoned from 1MDB.

How Jho Low managed the 1MDB PetroSaudi Joint Venture deal

![Brains behind PetroSaudi, Director Patrick Mahony]()

Brains behind PetroSaudi, Director Patrick Mahony

Among the email exchanges obtained by Sarawak Report are documents from an initial meeting that took place in New York on September 8th 2009, between the then Wynton Capital head, Jho Low and the UK businessman Patrick Mahony, who had been introduced a few days earlier by PetroSaudi’s CEO, Tarek Obaid.

Mahony worked for the investment group Ashmore, which was funding PetroSaudi’s main operation, an oil well in Argentina.

Also at the meeting were two of Jho Low’s close colleagues, Li Lin Seet and a UBG bank lawyer, Tiffany Heah.

In an email written to “Jho, Seet and Tiffany” the following day, Mahony made clear on behalf of PetroSaudi that the company was very willing to become involved in a series of deals proposed by Jho Low, which were expected to involve 1MDB and Petronas.

Mahony also understood that Jho Low wanted “to use PetroSaudi International as a front” for certain deals and he said that “we would be happy to do that”:

“Jho / Seet / Tiffany” begins the lengthy email

“….I think what would make sense is that we set up a joint venture where we contribute our assets and you can contribute cash to match our asset base. We can then decide where that cash goes. Some of it may go to paying us back for some cost and some should stay in the JV for new acquisitions. We can discuss how those acquisitions will work and how money should flow once we do the deals through the JV…. I am assuming here that 1MDB will be our partner first and that Petronas will come in later…. Over time, Petronas could buy the JV and both PSI and 1MDB would have made a big return on the initial investment.

Lastly, we know there are deals you are looking at where you may want to use PSI as a front, we would be happy to do that. You need to let us know where…. On this idea of being a front, we need your input”

[PSI FRONT EMAIL]

Patrick Mahony

To:Jho Low

Subject:Cover Email – Read First

Jho / Seet / Tiffany,

Many thanks for your time the other day. As discussed, there seems to be a number of things we can do together. However, I think we should try to focus on the more actionable ones for now and we can then spend more time exploring some of the other areas where we might be able to cooperate. In my mind, the immediate businesses to focus on are upstream oil and gas and oil services through PetroSaudi International (PSI) and related companies. Other than that, there are more opportunities we can discuss and I will mention them later. What I have tried to do below is break out the various deals and what some next steps might be. I will also be sending you presentations in separate emails (files are too big to send in one email) to give you more detail on each opportunity.

PetroSaudi – Upstream

This is the main deal and the first one we should work on together. The opportunity here is to buy into a platform with assets in Argentina and Turkmenistan at the moment but with good access to other assets in the Caspian, Middle East, Latin America and West Africa. There are many deals PSI on offer to PSI at the moment and, with the right financial and technical partner, we could close these quickly.

I have sent you for your reference a brief presentation on PSI and a quick one-pager on what the PSI story is and what the opportunity is for an investor/partner.

Briefly, we can value the Argentinean assets at around $50-$75m and the Turkmenistan asset at around $700m pre-border dispute being resolved and $1b-$1.5b after the border dispute is resolved. Argentina has approximately 30m barrels of oil and Turkmenistan 500m. If we do the deal we want with the Canadian company that currently owns the asset in Turkmenistan, we will also pick up a block in the Gambia but the value of this unclear at this point. Argentina also merits a good amount of discussion because there are different ways to look at this and it depends on our partner’s appetite for Argentina.

I think what would make sense is that we set up a joint venture where we contribute our assets and you can contribute cash to match our asset base. We can then decide where that cash goes. Some of it may go to paying us back for some cost and some should stay in the JV for new acquisitions. We can discuss how those acquisitions will work and how money should flow once we do the deals through the JV.

We also have a solid, experienced operating team in PSI and we can use them to work with Petronas when we decide it is time for Petronas to enter the JV or the assets directly. I am assuming here that 1MDB will be our partner first and that Petronas will come in later. If this is the case, we can have Petronas either come into the JV or partner with us directly at the asset level and fund the development costs. I somewhat favour the latter as this would guarantee funding for the assets for development and it is also very standard in the industry to have farm-ins by technical partners. Over time, Petronas could buy the JV and both PSI and 1MDB would have made a big return on the initial investment. This is just a thought on structure, we can obviously discuss what you have in mind and what you think would be appropriate. We can also merge our Turkmenistan asset with the one Petronas has (would make sense).

Lastly, we know there are deals you are looking at where you may want to use PSI as a front, we would be happy to do that. You need to let us know where. We can, for example, buy one oil and gas company in Indonesia (called Star Energy – I have guaranteed access to that deal) and could use that as a platform. On this idea of being a front, we need your input but if Indonesia is one place where you would like to be, we could buy this as a local platform to do more deals.

In Summary, I think PSI in upstream is the first deal we should look at together. I think we should aim at answering the following questions as a next step:

- Who will be the partner in the JV with PSI? 1MDB or Petronas?

- What is the right structure?

- How do you want to run DD on this? I have set up virtual data rooms for both Turkmenistan and Argentina but you need to help us help you and let us know what sort of teams will be conducting DD for you, what info they will want etc. From our side our full technical team out of London will be available to assist you and your team in your technical/asset DD. However any discussion on the JV and how that will work will only be with Tarek and me.

- What is a realistic timeline to close a deal (I think this will depend somewhat on 2 above)?

PetroSaudi – Oil Services

PSI has recently gotten involved in oil services through Ashmore, the emerging market fund manager I was telling you about. Ashmore owns a company called Neptune that has two drill ships and a semi-submersible and company called Rubicon that owns FPSO’s (Floating, Production, Storage and Offloading vessels). PSI has options to buy into these companies or buy them outright. (I have sent you presentations on both Neptune and Rubicon.)

Furthermore, PSI is in the process of forming a JV with Venezuela’s national oil company (PDVSA) to do oil services in Venezuela. There is a big opportunity here because many companies (Halliburton etc) are either looking to get out of Venezuela or are being forced out. What we are doing is taking over these assets (cheaply) and putting them in a JV with PDVSA, where PDVSA would guarantee very long term contracts on the assets. Venezuela has rapidly declining production and a big need to reverse this so the government is very focused on the country’s services industry and making sure Venezuela’s exploration and production is being looked after properly. We can easily invest quite a bit of money into this JV and get a fast return on cash through the contracts PDVSA would give the JV. We could also put some of the Neptune or Rubicon assets in this JV.

Another deal in this space is with the Schahin group in Brazil. Schahin are a very large construction and finance group in Brazil and the head of the group runs the Brazil-Arab Chamber of Commerce (which is how we know him). After making it big in construction and finance, Schahin decided to enter the offshore oil services sector, realising that Petrobras would be driving global demand for this industry going forward. They have since bought drill ships and semi-submersibles and have them all contracted out to Petrobras (this is rare in the industry, most people buy vessels and then look for contracts – here the contracts are there so revenue is guaranteed once the vessel is ready for service). Some of the vessels are still in ship yards in Korea and China and these require financing to complete them. The deal here is to provide Schahin with financing so that the ships get built and can start working on the guaranteed contracts from Petrobras. Schahin is already the largest offshore oil services company in Brazil and the opportunity here is to become a partner/shareholder in this company. This would put anybody who is serious about offshore oil services instantly in the country that will control approximately 30% of the offshore oil services market for the foreseeable future. We like this deal a lot and the partner, Schahin, is a stellar, blue-chip group in Brazil. Investment required here is approximately $600m.

In summary, the offshore oil services space is very interesting to us as it is an asset-intensive business that generates large, steady cash flow (day rates on these vessels are from $100k per day to $500k per day). You can leverage the assets with banks and the key is getting contracts with national oil companies where, again, the Saudi influence helps (as we have demonstrated in Venezuela). The deals in this space require large numbers so we need an investor with deep pockets if we are going to do this.

As discussed, it is my understanding that MISC, Petronas’ service company, has a desire to become big in this space. If so, we could make MISC larger overnight by selling them Neptune, Rubicon and then having them enter into this JV with the Venezuelan National Oil Company (that the Saudis can control because of the relationship in OPEC) and with Schahin, the largest supplier of offshore vessels to Petrobras, who in turn is the largest contractor of offshore vessels in the world (and where MISC already has an FPSO operating).

Again, there may be a 2-step transaction we can do here by first doing deals with 1MDB before getting MISC in. There is value in consolidating a few assets under one roof before the ultimate owner comes in. So 1MDB and PSI could again make a return on their investment before the ultimate buyer acquires the company. Again – just a thought on structure, you need to tell us what is achievable on your end and who will actually be doing this.

Next steps here would be:

- Determine whether MISC, Petronas or 1MDB have appetite for this space? If so, how much? Between an acquisition of Neptune+Rubicon, the JV with PDVSA and the Schahin deal we could be talking up to $2b of cash required (of course some of this is financeable).

- If this is interesting, decide which deals we should do first?

- Discuss structure.

- Let us know timing and how you would want to DD.

Other

As discussed, there are a few other areas we are active in and maybe some other areas you would like to work with us in. Below are areas we would certainly be willing to discuss with you.

- Saudi Arabia – are there any sectors/industries that Malaysia would like to be involved in in KSA? If so, we would be happy to discuss and see how we can help you enter the Kingdom for those areas.

- Waste Management – I have sent you a presentation on this business. As per my email earlier this evening, this is certainly a company and sector we like and we have the right ingredients of technical know-how, experienced management and government support to make this very successful globally. However the company is currently undergoing a bit of a restructuring and overhaul so we will not be ready to discuss M&A opportunities until January. In any case, I think we have plenty to do between now and then.

- Funds – do you invest in funds through Khazanah or any other sovereign pools in Malaysia? As discussed, we have access to a few managers we like and have helped them to get funds to manage from various Saudi sovereign sources. There are opportunities here to also get Malaysian funds under management with these managers and even buy pieces of the management company. There a few deals we can do here but need to understand if a) you have pension, SWF or other money that goes to independent fund managers and b) if you have interest in owning fund management businesses. One interesting structure would be for 1MDB (or another vehicle) to buy a stake in an asset management company (we have a few with teams with good track records) and then make sure that funds come in from whichever sovereign sources. We can discuss.

- Real Estate – we are putting together a fund (see presentation emailed) that will manage Saudi sovereign funds to invest in UK real estate. There is a benefit from being a sovereign investor in UK real estate because you don’t pay capital gains taxes. The idea here is to start with UK but then raise more Saudi sovereign funds over time and grow this to buy real estate internationally. We have a good team set up and are ready to go on this. We thought maybe we could make this a fund with both Malaysian and Saudi investors – a sort of joint Malaysian/Saudi real estate fund. We will own the management company here so we will obviously give a piece of it to whoever can bring funds to manage. Again, we can discuss.

- Other – we are happy to discuss anything from your end you would like us involved in.

I have tried to list the main things we are involved with above and have been very transparent. I know I don’t need to say this but a lot of the information I have given you is very confidential and the principals involved here would prefer to keep it that way. The idea is to be open so we don’t waste any time and can quickly see what we can do together.

I suggest we meet again soon to discuss all of this. We really need to nail down what deals interest you, structures and how funds would flow. What I have tried to think of here are deals that are very standard in the industries we are talking about and would therefore be very justifiable to any investment committee. I am also thinking of structures where funds need to move a few times, which generally makes it easier for any fees we would need to pay our agents.

I look forward to hearing from you.

Best,

Patrick

This letter from Mahony was also significant in that it conceded that PetroSaudi in fact had virtually no real “asset base”, even though the company planned to achieve a paper valuation for the purposes of the joint venture of well over $2 billion.

This valuation was to be based on an oil concession in Turkmenistan, which was actually still owned by a completely separate Canadian company, called Buried Hill, with whom Mahony had initiated negotiations for a possible joint venture in July:

“Briefly, we can value the Argentinean assets at around $50-$75m and the Turkmenistan asset at around .. $1b-$1.5b after the border dispute is resolved. Argentina has approximately 30m barrels of oil and Turkmenistan 500m. If we do the deal we want with the Canadian company that currently owns the asset in Turkmenistan, we will also pick up a block in the Gambia but the value of this unclear at this point”

Despite PetroSaudi being essentially valueless, therefore, it nevertheless apparently held one key advantage for Jho Low’s purposes of creating “a front” – the owner, a friend of the Director Tarek Obaid, was Prince Turki bin Abdullah, one of the sons of the then King of Saudi Arabia.

![Founding owner of PSI, Prince Turki bin Abdullah]()

Founding owner of PSI, Prince Turki bin Abdullah

Jho Low was clearly eager to move swiftly ahead with a deal, because from this date the correspondence shows that negotiations for the 1MDB PetroSaudi joint venture were conducted at a breakneck speed, all at the initiative of Jho Low and his team, who were skillfully abetted by the UK businessman Patrick Mahony.

Also dated on September 9th, for example, is an email sent by Jho Low’s colleague Li Lin Seet to Tarek Obaid and Patrick Mahony, on the subject: “Proposed Timeline For Joint Venture with PetroSaudi”.

In the email Seet said that Low had “spoken to the Top Boss” and that there was a “target to close a deal by 20th Sept where all agreements are signed and monies can be paid to PetroSaudi before end of Sept.”

Low, who was copied in on the email trail, ‘replied to all’ the next day:

“We need to move fast n we need as much detailed info u have as fast as possible. We want to sign and pay by sept 09. Wil be emailing out a timeline”[sic].

[EMAIL PROPOSED TIMELINE]

Great.

Sent via BlackBerry from T-Mobile

_____

From : Patrick Mahony

Date : Fri, 11 Sep 2009 00:55:57 +0200

To : Taek Jho Low <jho.low@gmail.com >; Seet Li Lin <seet.lilin@gmail.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Subject : Re: Proposed timeline for JV with PetroSaudi

Jho – fully understood. I have been preparing virtual datarooms for you, which we will give you access to. In terms of me emailing you the potential deals and some info, I apologise for the delay but we were working on signing a deal this week, which we finally did late last night and this has taken a lot of my time. I have also been in a different city everyday since I left you in new york. I am preparing something to send to you and you will get it overnight tonight. Thanks

_____

From : “jho.low@gmail.com”

Date : Thu, 10 Sep 2009 23:15:17 +0200

To : seet.lilin@gmail.com <seet.lilin@gmail.com >; Patrick Mahony <Patrick.Mahony@Petrosaudi.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Subject : Re: Proposed timeline for JV with PetroSaudi

We need to move fast n we need as much detailed info u have as fast as possible. We want to sign and pay by sept 09. Wil be emailing out a timeline.

Sent via BlackBerry from T-Mobile

_____

From : seet.lilin@gmail.com

Date : Thu, 10 Sep 2009 21:13:12 +0000

To : Patrick Mahony <Patrick.Mahony@Petrosaudi.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Subject : Re: Proposed timeline for JV with PetroSaudi

Hi Patrick,

Are you guys going to include the waste mgmt company as one of the assets? That would fall under our radar as well. Can you please include it?

Thanks

Sent via BlackBerry from T-Mobile

_____

From : Patrick Mahony

Date : Wed, 9 Sep 2009 20:13:40 +0200

To : Seet Li Lin <seet.lilin@gmail.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Subject : Re: Proposed timeline for JV with PetroSaudi

Yup – on my end should be me and tarek cc’ed on everything. Thanks

_____

From : SEET Li Lin

Date : Wed, 9 Sep 2009 19:52:19 +0200

To : Patrick Mahony <Patrick.Mahony@Petrosaudi.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Subject : Re: Proposed timeline for JV with PetroSaudi

Dear Tarek,

FYI. Jho has instructed me to keep you posted on our progress.

Regards

Seet

On Wed, Sep 9, 2009 at 12:34 PM, Patrick Mahony <Patrick.Mahony@petrosaudi.com >wrote:

I am gathering presentations for you and you will have an email from me latest tomorrow morning my time. This is good news. Many thanks. Patrick

_____

From : SEET Li Lin

Date : Wed, 9 Sep 2009 18:28:58 +0200

To : Patrick Mahony <Patrick.Mahony@Petrosaudi.com >

Subject : Proposed timeline for JV with PetroSaudi

Dear Patrick,

Jho has spoken to the top boss and received the following guidance:

1) Target to close a deal by 20th Sept where all agreements are signed and monies can be paid to PetroSaudi before end of Sept.

2) Arrange for official signing and meeting of dignitaries by end Sept

The key thing is the list of assets currently in PetroSaudi, their valuation and descriptions in order for us to proceed and drill down to the numbers.

Thanks

It is notable that none of these emails on the Proposed Timeline for the Joint Venture are copied to anyone from 1MDB.

“Storyline for 1MDB”

Indeed later emails show that it was not until September 15th that the CEO of 1MDB, Shahrol Halmi, and his Malaysian colleagues were involved in the proceedings and again it was on the initiative of Jho Low, who organised a conference call between the parties.

Email exchanges show how the PetroSaudi Directors collaborated with Low, Li Lin Seet and Tiffany Heah on how they would present the company to the team from 1MDB. They drew up what they called a Storyline for their Conference Call and Seet opened up with a number of suggestions:

From: SEET Li Lin <seet.lilin@gmail.com >

Date: Tue, 15 Sep 2009 17:26:00 +0200

To: Jho Low <jho.low@gmail.com >; Tiffany Heah <tiffany.heah@gmail.com >; Patrick Mahony <Patrick.Mahony@Petrosaudi.com >

Subject: Storyline for Conference call with 1MDB

Hi Patrick,

I will circulate you some information on 1MDB soon….

Storyline for Conference Call: Patrick and Shahrol

1) ????? Introduction on background

a. ?????? Emphasize on ties with Tarek and role of Tarek in KSA

b. ????? Emphasize on Prince Turki?s role in PSI

c. ?????? Hint that PSI is owned indirectly by King Abdullah.

2) ????? Events that has occurred

a. ?????? King Abdullah learnt about 1MDB from PM Najib Razak and spoke to PM about joint-investments between KSA and Malaysia through a JV.

b. ????? Prince Turki was tasked by King Abdullah to follow up on this matter and has met PM Najib Razak to re-iterate this desire. Leaders or both countries are committed to partnership between PSI and 1MDB.

c. ?????? In fact, both leaders will very much like a deal completed by end of September in order for it to be the centerpiece of their meeting on 30 th Sept 2009.

Patrick responded to Jho Low’s assistant advising more caution:

“Ok. Need to be careful about some of the things we say – especially things concerning the big man in KSA. Let’s please discuss before the call. Thanks”

Meanwhile both parties agreed there was no “need to mention about the assets or any oil & gas matter in this call” as such details would be handled later.

STORYLINE EMAIL TRAIL

From: Patrick Mahony

To: Patrick Mahony

Subject: Fw: Storyline for Conference call with 1MDB

Ok. Need to be careful about some of the things we say – especially things concerning the big man in KSA. Let’s please discuss before the call. Thanks

_____

From: SEET Li Lin <seet.lilin@gmail.com>

Date: Tue, 15 Sep 2009 17:33:41 +0200

To: Jho Low<jho.low@gmail.com>; Tiffany Heah<tiffany.heah@gmail.com>; Patrick Mahony<Patrick.Mahony@Petrosaudi.com>

Subject: Re: Storyline for Conference call with 1MDB

Patrick,

?

Jho will like to emphasize that we do not need to mention about the assets or any oil & gas matter in this call since information will be sent to 1MDB this Friday.

?

Thanks

_____

From: SEET Li Lin <seet.lilin@gmail.com >

Date: Tue, 15 Sep 2009 17:26:00 +0200

To: Jho Low <jho.low@gmail.com >; Tiffany Heah <tiffany.heah@gmail.com >; Patrick Mahony <Patrick.Mahony@Petrosaudi.com >

Subject: Storyline for Conference call with 1MDB

Hi Patrick,

I will circulate you some information on 1MDB soon. Also, please take note that Prince Turki needs to be in Malaysia on 30th Sept 2009 for signing. Kindly book his calendar.

Thanks

?

Storyline for Conference Call: Patrick and Shahrol

1) ????? Introduction on background

a. ?????? Emphasize on ties with Tarek and role of Tarek in KSA

b. ????? Emphasize on Prince Turki?s role in PSI

c. ?????? Hint that PSI is owned indirectly by King Abdullah.

2) ????? Events that has occurred

a. ?????? King Abdullah learnt about 1MDB from PM Najib Razak and spoke to PM about joint-investments between KSA and Malaysia through a JV.

b. ????? Prince Turki was tasked by King Abdullah to follow up on this matter and has met PM Najib Razak to re-iterate this desire. Leaders or both countries are committed to partnership between PSI and 1MDB.

c. ?????? In fact, both leaders will very much like a deal completed by end of September in order for it to be the centerpiece of their meeting on 30 th Sept 2009.

3) ????? Investment objectives of JV

a. ?????? Leverage on key strengths of both countries to invest in areas which may spur sustainable economic development in Malaysia.

4) ????? Timing and milestones

a. ?????? Given the pressing timeline, 1MDB might need to travel to Geneva next week to finalize deals

b. ????? Deal must be completed by 30 th September (signed and asset/cash injection completed)

5) ????? Other details

a. ?????? 5 board members, 3 from PSI, 2 from 1MDB. Usual reserve matters to protect 1MDB as minority.

b. ????? PSI will provide timeline and other drafts by this Friday, including structure etc.

c. ?????? New hires will be jointly agreed.

???????????????

?

?

After this conference call apparently took place it was again Jho Low who proceeded to initiate more formal written introductions between the 1MDB team and their future joint venture partners, through an email entitled “re-Introductions for PSI and 1MDB” – at this stage the two companies were only 10 days away from signing their initial billion dollar deal on 29th September.

![YAB PM Najib Razak - friend of Jho Low]()

YAB PM Najib Razak – friend of Jho Low

During this initial email introduction of September 18th, Jho Low again insinuated that he was representing the highest authorities, in this case the “YAB PM” directly, in the matter.

The twenty-something tycoon again focused on playing up PetroSaudi’s owner Prince Turki’s royal connection, impressing on the 1MDB Chief Executive an entirely untrue assertion, which was that the negotiations were officially connected to “furthering Saudi-Malaysia bi-lateral ties”.

This is not the only time that the correspondence shows Jho Low assuming a quasi governmental and diplomatic status in his dealings between Malaysia and the Middle East. Did the Foreign Ministry know anything about it and if not, whom was Jho Low representing?

“I am pleased to confirm as per YAB Prime Minister’s discussions with HM King Abdullah Al-Saud on furthering Saudi-Malaysia bi-lateral ties, together with YAB PM’s discussions with HRH Prince Turki Al-Saud, PetroSaudi and 1MDB is on track with respect to your USd2.5b JVC partnership. YAB PM has confirmed that he looks forward to the signing ceremony on 28 September 2009 to be attended by HRH Prince Turki Al-Saud.” said Jho Low to 1MDB’s Shahrol Halmi 18th September.

[INTRODUCTIONS EMAIL]

Bcc me and seet

Sent via BlackBerry from T-Mobile

_____

From : Patrick Mahony

Date : Mon, 21 Sep 2009 15:00:53 +0200

To : Robert Ho <robert.ho@tia.com.my >; Shahrol Halmi <shahrol.halmi@tia.com.my >; ‘jho.low@gmail.com’ <jho.low@gmail.com >; TarekObaid <Tarek.Obaid@Petrosaudi.com >

Subject : RE: Introductions for PSI and 1MDB

Great. Many thanks

From: Robert Ho [mailto:robert.ho@tia.com.my]

Sent: Monday, 21 September, 2009 2:57 PM

To: Patrick Mahony; Shahrol Halmi; ‘jho.low@gmail.com'; Tarek Obaid

Cc: ‘caseykctang@gmail.com’

Subject: Re: Introductions for PSI and 1MDB

Thanks, Patrick. It will be low key as the event will be closed door. No media presence but we will issue short press release. Am out now. Will send you the draft later.

Regards,

Robert

_____

From : Patrick Mahony <Patrick.Mahony@Petrosaudi.com >

To : Shahrol Halmi; Low, Jho (Personal) <jho.low@gmail.com >; Tarek Obaid <Tarek.Obaid@Petrosaudi.com >

Cc : ‘Casey Tang’ <caseykctang@gmail.com >; Robert Ho

Sent : Mon Sep 21 08:49:39 2009

Subject : RE: Introductions for PSI and 1MDB

Dear Shahrol,

Tarek has asked me to answer on his behalf as he is not able to get to a computer at the moment. First of all regarding the overview of PetroSaudi, I attach a brief presentation. This is a bit dated and only includes the upstream oil and gas ambition of PSI (it also does not have any asset specific data) but should give you a sense of what we are about. Obviously PSI will aim to invest in other areas as it works with you going forward.

With regard to liaising with Robert on what we can release to the media, I will be the point person. I would suggest you send to me a draft of what you would like to release and we will let you know if it works for us. PSI is very press shy and usually never announces our investments (one of the main reasons governments like to work with us) but we understand you will need to make some statements and we would be happy to make them jointly with you.

I look forward to meeting you in London and hearing from Robert.

All the best,

Patrick

Patrick Mahony

PetroSaudi International Ltd.

Tel: +41-78-86-888-68

patrick.mahony@petrosaudi.com

From: Shahrol Halmi [mailto:shahrol.halmi@tia.com.my]

Sent: Sunday, 20 September, 2009 10:40 AM

To: Low, Jho (Personal); Tarek Obaid

Cc: ‘Casey Tang'; Patrick Mahony; Robert Ho

Subject: RE: Introductions for PSI and 1MDB

Importance: High

Thanks Jho

Dear Tarek, pleased to make your acquaintance. Looking forward to meeting face to face next week.

I understand that you’ve couriered over a copy of PSI’s company profile late last week. Unfortunately it being a long weekend over here in Malaysia, we haven’t received anything yet.

In the spirit of moving as expeditiously as possible, would it be possible for Robert, our Corporate Communications person to liaise directly with his PSI equivalent to get going on joint statements, and to agree on levels of detail we are comfortable with releasing to the media?

Sincerely,

Shahrol

From: Low, Jho (Personal) [mailto:jho.low@gmail.com]

Sent: Friday, 18 September, 2009 8:31

To: ‘Shahrol Halmi'; Tarek.Obaid@petrosaudi.com

Cc: ‘Casey Tang'; ‘Patrick Mahony’

Subject: Introductions for PSI and 1MDB

Importance: High

Hi Tarek, Shahrol,

I am putting the both of you together as per the mutual interests of PetroSaudi and 1Malaysia Development Berhad (1MDB)

I am pleased to confirm as per YAB Prime Minister’s discussions with HM King Abdullah Al-Saud on furthering Saudi-Malaysia bi-lateral ties, together with YAB PM’s discussions with HRH Prince Turki Al-Saud, PetroSaudi and 1MDB is on track with respect to your USd2.5b JVC partnership.

YAB PM has confirmed that he looks forward to the signing ceremony on 28 September 2009 to be attended by HRH Prince Turki Al-Saud.

Would appreciate if you could keep the working group to a PNC – 4 member list serve as I understand due to the urgency of the matter, NDAs have not been signed, and PSI in participate is quite sensitive about information flow in respect of HRH.

My suggestion is have Patrick and Casey work the details reporting back to Tarek and Shahrol for decision making, etc.

Thank you.

(I trust all of you can now officially communicate and don’t need to cc me for proper governance purposes)

![Shahrol Halmi - out of the loop]()

Shahrol Halmi – out of the loop

Jho Low had also reassured his 1MDB correspondents, therefore, that they were “on track with respect to your USD$2.5 billion Joint Venture partnership”, despite having been advised from the start that PetroSaudi would be bringing zero cash to the deal, only its supposed assets.

The extent to which Shahrol Halmi was still playing catch up is revealed later in the same email trail, when the 1MDB chief admitted two days later on 20th September that he had yet to receive or read anything about the company he was due to start billion dollar joint venture negotiations with the following week in London:

From: Shahrol Halmi [mailto:shahrol.halmi@tia.com.my]

Sent: Sunday, 20 September, 2009 10:40 AM

To: Low, Jho (Personal); Tarek Obaid

Cc: ‘Casey Tang'; Patrick Mahony; Robert Ho

Subject: RE: Introductions for PSI and 1MDB

Importance: High

Dear Tarek, pleased to make your acquaintance. Looking forward to meeting face to face next week. I understand that you’ve couriered over a copy of PSI’s company profile late last week. Unfortunately it being a long weekend over here in Malaysia, we haven’t received anything yet. [1MDB CEO Shahrol Halmi, 20th Sept]

In response Patrick Mahony sent him on Tarek’s behalf:

“a brief presentation. This is a bit dated and only includes the upstream oil and gas ambition of PSI (it also does not have any asset specific data) but should give you a sense of what we are about.” Mahoney also warned Halmi that PSI is “very press shy” .. .(one of the main reasons governments like to work with us)” and he therefore required to be sent advance drafts of any planned publicity.

[POWER POINT PRESENTATION ATTACHED]

Three days later on Wednesday 23rd September a team from 1MDB, including Halmi, was already over in London, supposedly negotiating the terms of the deal.

Yet again, the correspondence shows the whole set up was organised and arranged by Jho Low, with his assistant Li Lin Seet contacting PetroSaudi beforehand to strategise the meeting at the offices of oil company’s own lawyers, White & Case.

Jho Low would of course attend as a go-between, as the emails made clear:

From: Seet Li Lin [mailto:seet.lilin@gmail.com]

Sent: Monday, 21 September, 2009 2:06 PM

To: Patrick Mahony

Subject: Meeting in LDN

Hi Patrick,

Jho is tied up in meetings and could not do the call. He requests that you bcc himself and me in any correspondence to 1MDB. Also, the meeting on Wednesday is expected from 11am to 5pm. Can you get White and Case to book 2 meeting rooms. 1 for 1MDB and PSI. 1 for Jho and PSI.

In the same email exchange Seet explains to PetroSaudi’s Patrick Mahony that, as far as 1MDB was concerned, matters were a done deal:

“Jho has softened the ground so the 1MDB ppl are expected to come and meet, chat to know each other and sign.” Seet wrote to Mahony a couple of days beforehand.

SEPARATE MEETING ROOMS EMAIL

Ok. Thanks. Yes – W&C

—–Original Message—–

From: Seet Li Lin <seet.lilin@gmail.com>

Date: Mon, 21 Sep 2009 15:54:21

To: Patrick Mahony<Patrick.Mahony@Petrosaudi.com>

Subject: Re: Meeting in LDN

Hi, give us a couple more hours for JVA.

Meeting in LDN on Wed will be at White and Case?

——Original Message——

From: Patrick Mahony

To: Li Lin Seet (gmail)

Subject: RE: Meeting in LDN

Sent: Sep 21, 2009 14:34

Thanks. ETA for first draft of agreement is still in a few hours…?

—–Original Message—–

From: Seet Li Lin [mailto:seet.lilin@gmail.com]

Sent: Monday, 21 September, 2009 3:33 PM

To: Patrick Mahony

Subject: Re: Meeting in LDN

Understand. Will do just that. Will prep B and M lawyers.

——Original Message——

From: Patrick Mahony

To: Li Lin Seet (gmail)

Subject: RE: Meeting in LDN

Sent: Sep 21, 2009 13:26

Ok. I’ve just been bbm’ing with jho and i think we need their counsel to stay longer in case. I also need to get the 1mdb lawyer and my lawyer in touch asap. I will wait until you send the jva but what i suggest is that when you send me the jva, you introduce me to your lawyers by email and then i will forward the jva to my lawyers and introduce my lawyers to your lawyers. Thanks

—–Original Message—–

From: Seet Li Lin [mailto:seet.lilin@gmail.com]

Sent: Monday, 21 September, 2009 2:06 PM

To: Patrick Mahony

Subject: Meeting in LDN

Hi Patrick,

Jho is tied up in meetings and could not do the call.

He requests that you bcc himself and me in any correspondence to 1MDB.

Also, the meeting on Wednesday is expected from 11am to 5pm. Can you get White and Case to book 2 meeting rooms. 1 for 1MDB and PSI. 1 for Jho and PSI.

Jho has softened the ground so the 1MDB ppl are expected to come and meet, chat to know each other and sign. Their legal counsel will be here as well.

Thanks

Jho Low crafted the whole Joint Venture deal before either PetroSaudi or 1MDB saw what was the plan

These same emails provide the equally telling information that the first draft copy of the Joint Venture deal to be negotiated with 1MDB was drawn up by Jho Low’s own office.

On the 21st September, two days before negotiations were due to start on the billion dollar deal, that draft was still being eagerly anticipated by Low’s contacts at PetroSaudi.

Mahony Sep 21, 2009 14:34: “ETA for first draft of agreement is still in a few hours…?

Seet Li Lin 21 Sep 2009 15:54:21: “Hi, give us a couple more hours for JVA”

PetroSaudi’s Patrick Mahony then suggests to Seet that his lawyers and Jho Low’s lawyers should first liaise with each other, before they contacted 1MDB’s lawyers, about the content of the proposed Joint Venture document being drawn up by Jho Low’s team in New York:

From: Patrick Mahony,

To: Li Lin Seet (gmail),

Subject: RE: Meeting in LDN Sent: Sep 21, 2009 13:26

“I also need to get the 1mdb lawyer and my lawyer in touch asap. I will wait until you send the jva but what i suggest is that when you send me the jva, you introduce me to your lawyers by email and then i will forward the jva to my lawyers and introduce my lawyers to your lawyers. Thanks”,

The inescapable conclusion is that the jet-lagged team, arriving from Malaysia the next day, had acted as little more than on-lookers in the drawing up of this ‘joint venture’, for which only they would be putting up any cash, on behalf of the Malaysian public.

According to the contract about to be place on the table in front of them USD$1 billion was due on day one, with a further drawing rights available of up to USD$5 billion.

Final moves – how Jho Low orchestrated a “loan repayment” due to PetroSaudi into a “premium” destined for his own Good Star account

Last week Sarawak Report triggered outrage when it revealed the details of the original Joint Venture Agreement, signed by 1MDB and PetroSaudi on 29th September 2009, which till then had been kept secret.

![Key player - Jho Low's side kick Li Lin Seet, signatory of Good Star]()

Key player – Jho Low’s side kick Li Lin Seet, signatory of Good Star

The reason for the anger was discovery of a massive USD$700 million “loan repayment” obligation placed on 1MDB, supposedly due to ‘pay back a loan’ owed to PetroSaudi’s parent company on the signing of the deal.

It had been agreed this money would be paid out of the billion dollars contributed by 1MDB, writing off 2/3 of its investment.

However, telling emails written by Patrick Mahony at the very same time to the Swiss private bank BSI, show that while the money was being described as a loan repayment under the terms of the joint venture, he preferred to describe this whopping sum as a “premium” (bonus) to the prospective recipient bank:

From: Patrick.Mahony@Petrosaudi.com

To: chr.zuc.a1@bsibank.com

Subject: Additional information please

“….The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

EMAIL: ‘LOAN’ OR ‘PREMIUM’?

From: chr.zuc.a1@bsibank.com

To: Patrick.Mahony@Petrosaudi.com

Subject: Additional information please

Dear Patrick,

Please let us come back on our questions, my compliance needs some additional information before sending her presentation to our General Management.

_________________________________________________________________

1. Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explain

PM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

We please need additional details on the remaining 700 m : beneficiaries, location, depositary bank ?

It seems that the Malaysian Sovereign Fund invests only in Malaysia. Is this money going back to Malaysia f.ex. and if so, when ?

_________________________________________________________________

2. Joint Venture Contract :

PM: The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia) .

Our Compliance please needs the draft agreement between the contracting partners.

It is difficult for her to give an opinion to our General Management on the deal without the joint venture draft.

_________________________________________________________________

3. “1 Petro Saudi International Holdings Cayman Ltd (Cayman) ”

What is the purpose of this account and how will it be used please ?

__________________________ _________________________________________________________________

Thank you

Christophe Zuchuat

Directeur Adjoint

BSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. +41 58 809 13 52 – Fax +41 22 809 43 03

chr.zuc.a1@bsibank.com – www.bsibank.com

________________________________________

From: Patrick Mahony [mailto:Patrick.Mahony@Petrosaudi.com]

Sent: mercredi, 23. septembre 2009 23:21

To: Zuchuat Christophe (BSI-Geneve)

Subject: RE: Feedback compliance positive / GM also

Sensitivity: Confidential

Please see answers below. Let’s discuss tomorrow. Merci

From: chr.zuc.a1@bsibank.com [mailto:chr.zuc.a1@bsibank.com]

Sent: Wednesday, 23 September, 2009 5:33 PM

To: Patrick Mahony

Subject: Feedback compliance positive / GM also

Sensitivity: Confidential

Dear Patrick,

Thank you for your valuable information and help.

Our compliance is currently consolidating all information,

and will submit it to our General Management who is already informed.

Overall, the outlook is quite positive.

Allow me 3 questions please :

____________________

Business Plan

Outflows

USD 100 JP Morgan London

USD 200 remains at 1MDB Petro Saudi Ltd (BVI)

USD 700 will go to various accounts to be opened at BSI (says Tarik Obaid) – to explain

Can you explain us briefly where and how the money will be invested ?

We suppose the business plan is financing oil investments/projects.

1. My compliance has to give some sort of explanation on the 700 especially .

We are very happy it stays at BSI.

PM: The 100 (at JPM) and 200 (at BSI) will be used to fund the assets costs – basically exploration and production costs – and also to purchase assets. The 700m is premium that was made in the transaction and will be used to fund future transactions in any sector (not necessarily oil and gas)

_______________________

2. Joint Contract : it is not clear between which entities the contract will be :

Joint Venture Contract between : linked to cash flow ?

• 1Malaysia Development Bhd (Malaysia)

• 1MDB Petro Saudi Ltd (BVI)

Joint Venture Contract between : linked to ownership ?

• 1 Petro Saudi International Holdings Cayman Ltd (Cayman)

• 1MDB Petro Saudi Ltd (BVI)

PM: I don’t follow question, let’s discuss tomorrow. The JV company is the BVI company called 1MDB PetroSaudi Ltd and this is a JV between PetroSaudi International (Holding) Cayman Ltd and 1 Malaysia Development Berhad (Malaysia).

__________________________

PricewaterhouseCoopers

3. Valorization of Argentinean and Turkmenistan’s Assets : very important to get please

PM: This will happen but may be another competent authority as PWC is being too slow.

__________________________

Thank you for your important support

Best regards

Christophe Zuchuat

Directeur Adjoint

BSI SA

8, Boulevard du Théâtre – 1204 Genève

Tel. +41 58 809 13 52 – Fax +41 22 809 43 03

chr.zuc.a1@bsibank.com – www.bsibank.com

This explanation given by Mahony to BSI clearly contrasts with the reason provided in the joint venture agreement for the removal of the money, which said that PetroSaudi’s parent company had injected the loan into the subsidiary it had created to take part in the deal – but then (naturally) expected the money back once the joint venture was signed.

![Jho Low's lawyer, Tiffany Heah]()

Jho Low’s lawyer, Tiffany Heah

Our research has shown that this careful repayment provision had been written in to the very first draft of the agreement, provided by Jho Low’s own legal team in New York, which was sent over to PetroSaudi by lawyer Tiffany Heah.

From: Tiffany Heah

To: Patrick Mahony

Date: Mon, 21 Sep 2009 12:36:37 -0400

Subject: JVA

Attachment(s): 1

DRAFT ORIGINAL JOINT VENTURE DOCUMENT FROM JHO LOW’S LAWYERS

It can be seen through a series of drafts over the course of the following week that the PetroSaudi legal team from White & Case in London, headed by the lawyer Tim Buckland, then re-wrote, added to and refined the clause, arguably strengthening its provisions, while making the wording more subtle.

FINAL JV DOCUMENT

That entire process was completed in just one week, between the presentation of Jho Low’s original version of the contract at the key first London meeting on 23rd September and the signing of the joint venture on 29th.

And during that fevered period, this expensive team of London lawyers kindly provided a couple of power point presentations, in order to break down the whole procedure for the less gifted brains involved:

JOINT VENTURE STRUCTURE STEPS PLAN POWER POINT

One of the most interesting aspects of the above White & Case power point presentation, designed for the negotiations for 1MDB 23rd September, is how closely it resembles the presentation sent over to PetroSaudi by Jho Low’s underling Li Lin Seet a week earlier on September 14th:

From: SEET Li Lin

To: Patrick Mahony, Tarek.Obaid@petrosaudi.com

CC: Jho Low, Tiffany Heah

Date: Mon, 14 Sep 2009 02:17:52 -0400

Subject: Re: Proposed conference call: 330pm (US Eastern time)

Attachment(s): 1

Dear Tarek and Patrick,

We will be using the following set of presentation for our discussion.

Do let me know if the proposed timing is good for you all.

JOINT VENTURE STRUCTURE INTERNAL PRESENTATION POWER POINT

Shortly after the signing of the deal Buckland resigned his position at White and Case and took up his present job – as a Director of PetroSaudi.

!["Seen no evidence" that Jho Low has ever been involved - CEO Arul Kanda Kandasamy]()

“Seen no evidence” that Jho Low has ever been involved – CEO Arul Kanda Kandasamy

Likewise, Patrick Mahony, who had been employed as an investment banker by the hedge fund Ashmore during the period of his engagement in the PetroSaudi negotiations, also resigned his position straight after, in favour of a Directorship at PetroSaudi’s plush, brand new offices in Curzon Street, in the heart of London’s Mayfair

Yet, despite all the evidence, 1MDB’s brand new CEO, Arul Kanda Kandasamy, was still maintaining last week in statements to journalists that he has been able to find no evidence whatsoever of any involvement by Jho Low in the affairs of 1MDB.

Bank transfers

What that evidence goes on to show is that the critical manoeuvres for transferring the USD$700 million “loan” cum “premium” into the control of Jho Low took place straight after the signing of the agreement on the 29th September – that and Jho Low was involved and copied in on every step.

![Jho Low - on the case with 1MDB]()

Jho Low – on the case with 1MDB

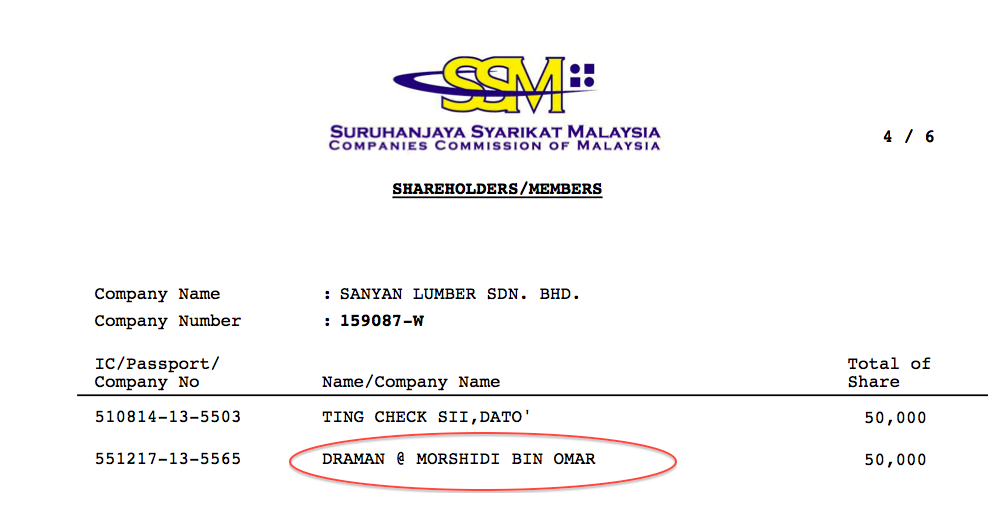

We have copies of a ‘PetroSaudi Loan Agreement’, which had been drawn up by White & Case indicating that this vast sum of money had been loaned from the parent company PetroSaudi Cayman Holdings to 1MDB PetroSaudi on 25th September.

The letter was signed by PetroSaudi’s boss, the twenty something Tarek Obaid.

However, there is no evidence to suggest that this ‘loan’ was anything apart from an entirely contrived transaction between two arms of PetroSaudi, a company with very little working capital.

Three days later 1MDB was committed to pay it back in hard currency.

PETROSAUDI LOAN AGREEMENT 25th Sept 09

In order to complete the heist of $700 million from 1MDB into the Jho Low controlled account that was waiting for it, the CEO of 1MDB Shahrol Halmi needed to concede to a ‘repayment’ request under the joint venture agreement crafted by Jho Low.

The documentation for this completion of the deal was again clearly collaborated between Jho Low and Patrick Mahony’s team of lawyers from White & Case.

Mahony sent Jho Low an email on 30th September entitled Funding/ Completion Instructions and Documentation, which contained 7 crucial documents, including a so-called letter of demand for the $700 million ‘loan’ as well as last minute instructions on bank account changes:

EMAIL FUNDING / COMPLETION INSTRUCTIONS AND DOCUMENTATION

1MDB_TKC_director_acceptance_letter.pdf

1MDB_SABIH_director_acceptance_letter.pdf

1MDB_PetroSaudi_Limited_Written_Resolutions.pdf

Loan_Repayment_Demand_2.pdf

Form_A.pdf

Signatories_letter.pdf

PetroSaudi_Letter_of_Agreement.pdf

From: Patrick Mahony

To: jho.low@gmail.com

Date: Wed, 30 Sep 2009 00:18:09 +0200

Subject: FW: Funding/ Completion Instructions and Documentation

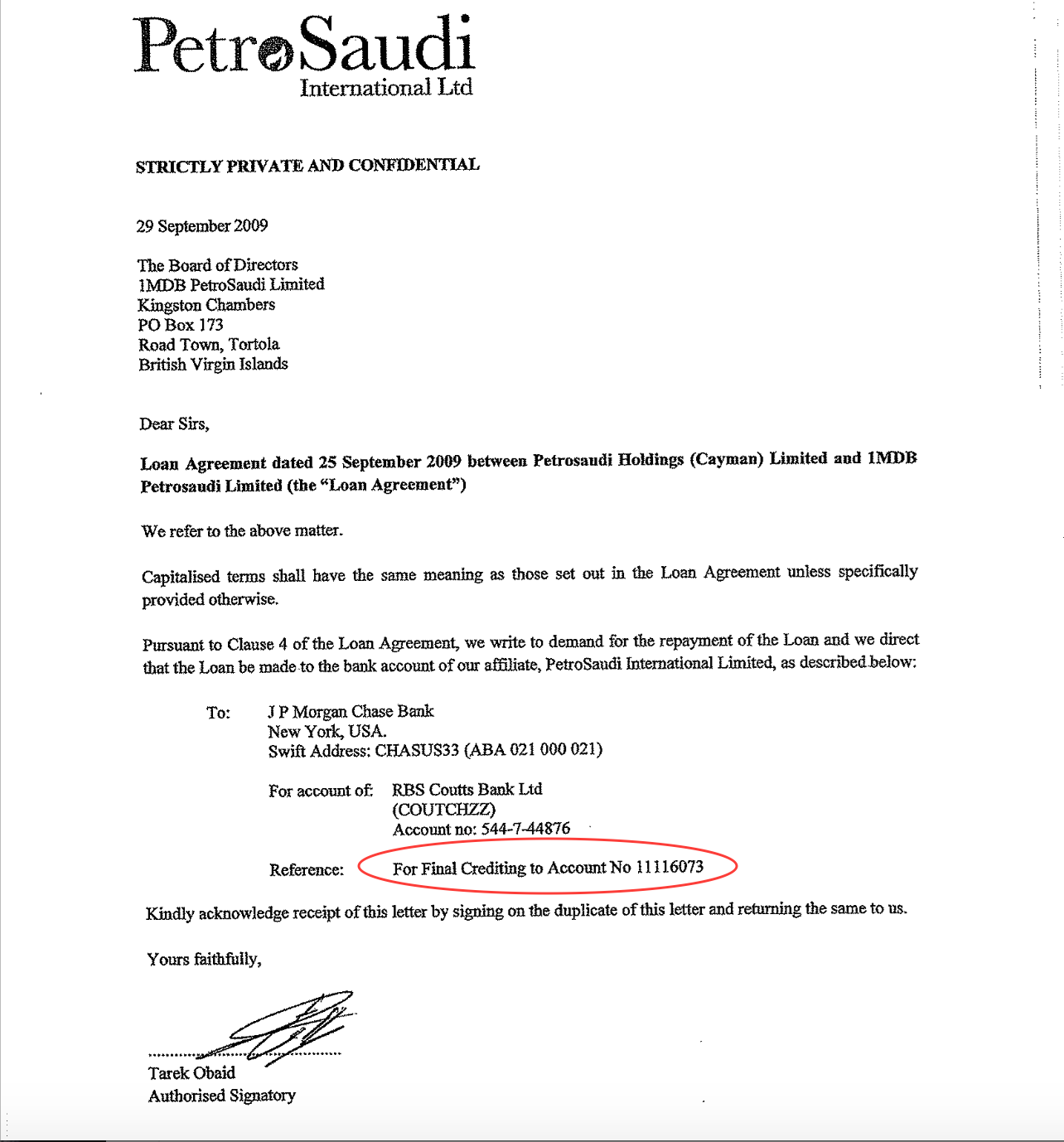

The letter of demand, signed by PetroSaudi CEO Tarek Obaid, to 1MDB required the immediate “repayment of the “loan” of $700 million from the 1MDB PetroSaudi joint venture company to what he describes as “the bank account of our affiliate PetroSaudi International Limited”.

![Pterosaur boss cited a Good Star account for receiving the 'repayment']()

PetroSaudi CEO had cited a Good Star account for “Final Crediting”

However, Sarawak Report has been able to establish from the extensive documentation that the above account at RBS Coutts in Zurich did not in fact belong to PetroSaudi, or to an affiliate.

Rather it was registered in the name of a company called Good Star Limited, which is a company controlled by Jho Low.

![Account details for Good Star match the 1MDB payment]()

Mahony and Tarek Obaid received payments from Good Star – their account details for Good Star match the 1MDB payment

This means that the money, which was stated as having been paid back to PetroSaudi as part of the joint venture agreement, was in fact signed over by Tarek Obaid to an entirely separate third party, Good Star Limited.

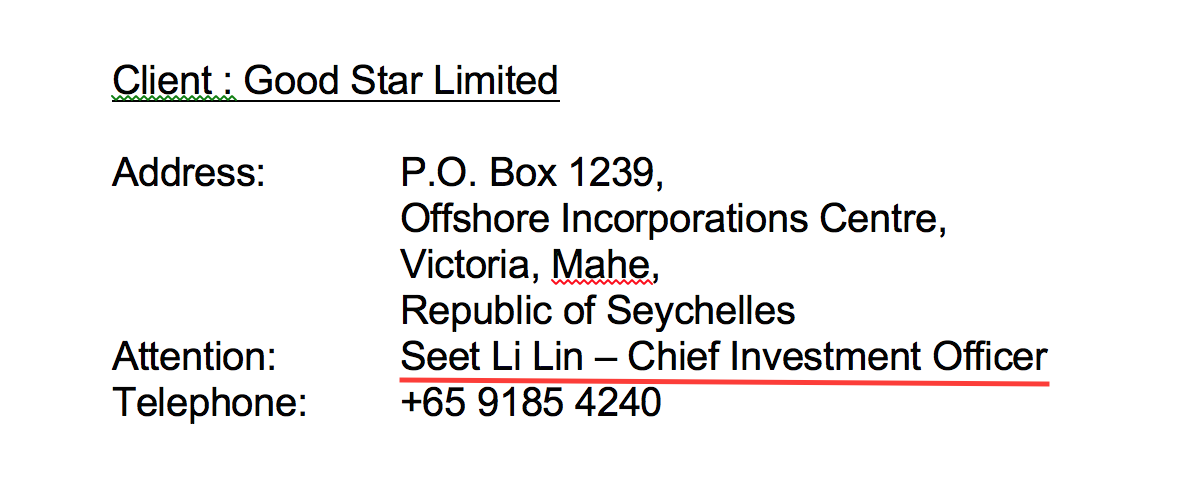

![Signatory for Good Star is Li Lin Seet]()

Signatory for Good Star is Li Lin Seet

Jho Low has publicly stated, time and again, that he has had nothing whatsoever to do with the investment activities of 1MDB and that he has received no money or benefits from the development fund.

However, Sarawak Report has established from the documentation that the signatory and Chief Investment Officer for Good Star was none other than Jho Low’s deputy Li Lin Seet.

Seet had acted as the tycoon’s key right hand man throughout the management of the deal between 9th-29th September 2009 and was copied in on all the correspondence we have received relating to the deal.

![Chief Investment Officer and signatory of Good Star]()

Chief Investment Officer and signatory of Good Star

The Singapore number listed above, was included in a contract signed on 29th September between Good Star and Patrick Mahony, straight after the joint venture agreement with 1MDB.

We have established that it still belongs to Seet Li Lin, who is now the Vice-President of Jho Low’s company Jynwel Capital.

Seet returned our call made to this number last week, confirming his identity and his role at Jynwel. But, when we asked about Good Star and his role as its Chief Investment Officer he said:

“What? I don’t know what you are talking about” and then turned off his phone.

Shahrol Halmi knew all along – RBS Coutts, the Queen of England’s own bank

Yet another email trail in this fascinating set of documents involves last minute frantic interchanges between the banks involved in transferring this huge sum of money to Good Star.

These make clear that the head of 1MDB knew that this company was the destination for the $700 million, not an affiliate of PetroSaudi.

Because, when 1MDB’s own bank, Deutsche Bank Malaysia, came back asking for confirmation on behalf of RBS Coutts Zurich as to the identity of “the beneficiary with regard to the 1MDB remittance” Halmi replied to his banking officer Jacqueline Ho:

“From : Shahrol Halmi

Date : Fri, 2 Oct 2009 08:21:15 -0400

To : ‘jacqueline.ho@db.com’ <jacqueline.ho@db.com >; Casey Tang <casey.tang@tia.com.my >

Subject : Re: RESEND : URGENT REQUEST OF RBS COUTTS

Jac, please use this address for GOOD STAR LIMITED.

P.O.Box 1239, Offshore Incorporation Centre, Victoria, Mahe, Republic of Seychelles

Thanks

The PetroSaudi team and Jho Low were copied into this email exchange and Jho Low commented to Patrick Mahony:

“Shld be cleared soon. Pls update tarek.”

Surely, the head of 1MDB must have been aware that Good Star was an account that had nothing to do with PetroSaudi’s official company structure, since there was no record of it in the PetroSaudi International group of companies?

EMAILS URGENT REQUEST OF RBS COUTTS

Sent via BlackBerry from T-Mobile

_____

From : jho.low@gmail.com

Date : Fri, 2 Oct 2009 12:28:01 +0000

To : <patrick.mahony@petrosaudi.com >

Subject : Fw: RESEND : URGENT REQUEST OF RBS COUTTS

Shld be cleared soon. Pls update tarek.

Sent via BlackBerry from T-Mobile

_____

From : Shahrol Halmi

Date : Fri, 2 Oct 2009 08:21:15 -0400

To : ‘jacqueline.ho@db.com’ <jacqueline.ho@db.com >; Casey Tang <casey.tang@tia.com.my >

Subject : Re: RESEND : URGENT REQUEST OF RBS COUTTS

Jac, please use this address for GOOD STAR LIMITED.

P.O.Box 1239, Offshore Incorporation Centre, Victoria, Mahe, Republic of Seychelles

Thanks

_____

From : Jacqueline Ho <jacqueline.ho@db.com >

To : Casey Tang; Shahrol Halmi

Sent : Fri Oct 02 06:19:20 2009

Subject : RESEND : URGENT REQUEST OF RBS COUTTS

Dear Casey and Shahrol

Please see an email request from RBS Coutts to reveal the beneficiary name pertaining to 1MDB’s remittance.

In that sense, I believe RBS needs confirmation on the beneficiary’s name in order to complete their internal risk mitigating processes as no name was

We will await your instructions on whether to reveal the beneficiary name and address (please provide) to RBS Coutts.

As requested by them, we will have to send it out via email and an authenticated swift message so would appreciate a reply as soon as possible.

Best Rgds

Jacqueline Ho

Corporate Coverage

Deutsche Bank (M) Bhd

Tel: + 603 20317798

Mob: +6012 2059561

Email: jacqueline.ho@db.com

—

This e-mail may contain confidential and/or privileged information. If you

are not the intended recipient (or have received this e-mail in error)

please notify the sender immediately and destroy this e-mail. Any

unauthorized copying, disclosure or distribution of the material in this

e-mail is strictly forbidden. —– Forwarded by Jacqueline Ho/db/dbcom on 10/02/2009 05:41 PM —–

Prakash Gopi/db/dbcom

10/02/2009 04:55 PM

To Jacqueline Ho/db/dbcom@DBAPAC

cc Jeremy Lewis/db/dbcom@DBAPAC

Subject Fw: REQUEST OF COUTCHZZ

Jac,

RBS Coutts is requesting for bene’s full details.

Can we proceed to provide the necessary information. If so, appreciate if you could provide me with the relevant details.

Warm Regards,

Prakash Gopi

Global Market Operations

Deutsche Bank (M) Bhd

03-20536851

—– Forwarded by Prakash Gopi/db/dbcom on 02/10/2009 04:53 PM —–

Laurent.Schmid@rbscoutts.com

02/10/2009 04:38 PM

To Prakash Gopi/db/dbcom@DBAPAC

cc Eliane.Humair@rbscoutts.com, Thomas.Tuerler@rbscoutts.com

Subject RE: REQUEST OF COUTCHZZ

Dear Prakash,

Please urgently confirm the full name of the final beneficiary of the funds per e-mail and authenticated swift (see details below) in order for us to apply the funds.

We are not in a position to credit the funds without full beneficiary details (full name, address, account no.).

Kind regards,

Mr Laurent Schmid

Regulatory Risk

RBS Coutts Bank Ltd

Lerchenstrasse 18

P.O. Box

8022 Zurich, Switzerland

Tel. +41 43 245 53 52

Fax +41 43 245 54 04

laurent.schmid@rbscoutts.com

www.rbscoutts.com

____

From: Humair, Eliane (RBS Coutts, CH)

Sent: Freitag, 2. Oktober 2009 10:27

To: Cousin, Dominik (RBS Coutts, CH); Tuerler, Thomas (RBS Coutts, CH); Schmid, Laurent (RBS Coutts, CH)

Subject: FW: REQUEST OF COUTCHZZ

TO URGENT

Eliane Humair

Investigations Department

RBS Coutts Bank Ltd

Stauffacherstrasse 1

P.O. Box

8022 Zürich

Telephone +41 (0)43 245 58 62

Facsimile +41 (0)43 245 57 99

eliane.humair@rbscoutts.com

www.rbscoutts.com

_____

From: Prakash Gopi [ mailto:prakash.gopi@db.com]

Sent: Freitag, 2. Oktober 2009 10:22

To: Humair, Eliane (RBS Coutts, CH)

Cc: Jeremy Lewis; Krystof Balwierz

Subject: Fw: REQUEST OF COUTCHZZ

Dear Eliane,

I have received this msg from Krystof Balwierz on behalf of yourself today.

May i urgently enquire what further details you require from DEUTMYKL since our MT103 msg had indicated that the funds were to be credited to acc 11116073.

Thank you.

Warm Regards,

Prakash Gopi

Global Market Operations

Deutsche Bank (M) Bhd

03-20536851

—– Forwarded by Prakash Gopi/db/dbcom on 02/10/2009 04:13 PM —–

Chooi-Fong Liew/db/dbcom

02/10/2009 04:09 PM

To Krystof Balwierz/db/dbcom@DBCOM cc

Prakash Gopi/db/dbcom@DBAPAC Subject

Fw: REQUEST OF COUTCHZZ

Hi Krystof

I have forwarded the email to my colleague who is handling this. You can laise directly with him direclty.

Regards.

Chooi fong

—– Forwarded by Chooi-Fong Liew/db/dbcom on 10/02/2009 04:06 PM —–

Chooi-Fong Liew/db/dbcom

10/02/2009 04:01 PM

To Prakash Gopi/db/dbcom@DBAPAC cc

Subject

Fw: REQUEST OF COUTCHZZ

Pls help.

—– Forwarded by Chooi-Fong Liew/db/dbcom on 10/02/2009 04:01 PM —–

Chooi-Fong Liew/db/dbcom

10/02/2009 03:59 PM

To Connie Lam/db/dbcom@DBAPAC, Umadevi Maslamani/db/dbcom@DBAPAC cc

Subject Fw: REQUEST OF COUTCHZZ

HI

Pls note email below . Did you send the pymt instruction? Bene Bank unable to apply. Pls provide addl details via BKTRUS33.

Thanks.

Chooi fong

Thanks to Halmi’s positive intervention, the $700 million transfer appears to have been finally banked later that day.

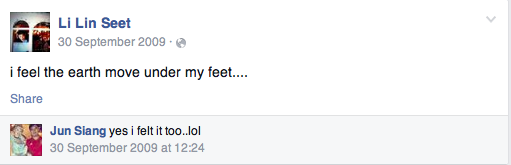

Jho Lo’s side-kick Li Lin Seet provided a series of comments on Facebook during this period of dealmaking. On September 30th, the day the money was transferred from 1MDB he gushed:

![The deal is clinched]()

The deal is clinched

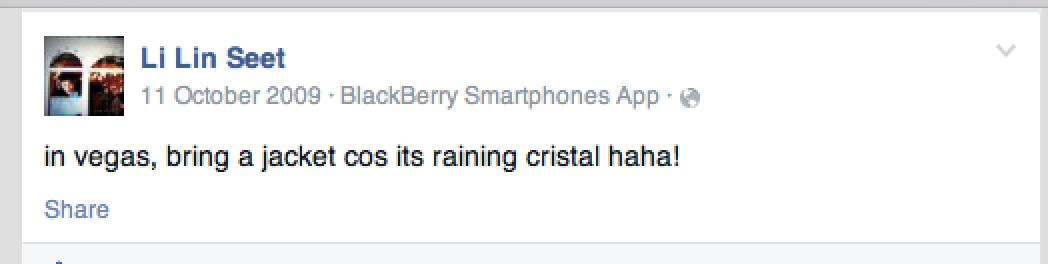

Ten days later, with the money securely transferred, he and his friends were clearly living it up in Vegas:

![Raining Cristal - the world's most expensive champagne thanks to Malaysia's diverted development money?]()

Raining Cristal – the world’s most expensive champagne – was this all thanks to Malaysia’s diverted development money?

Jho Low’s inner team were not the only ones with reason to celebrate.

On the same day that Tarek Obaid sent his letter of demand to 1MDB, on 29th September, Good Star also issued two contracts, signed by Jho’s underling Li Lin Seet.

One contract was to Tarek Obaid himself, paying him a “broker fee of USD$85 million”‘

DOCUMENT GOOD STAR TAREK

The other contract was from Good Star to Patrick Mahony, hiring him as an Investment Manager for a fund also of $85 million, but with a planned leverage of up to $500 million.

This contract entitled Mahony to a baseline 2% management fee, per annum.

DOCUMENT GOOD STAR MAHONY

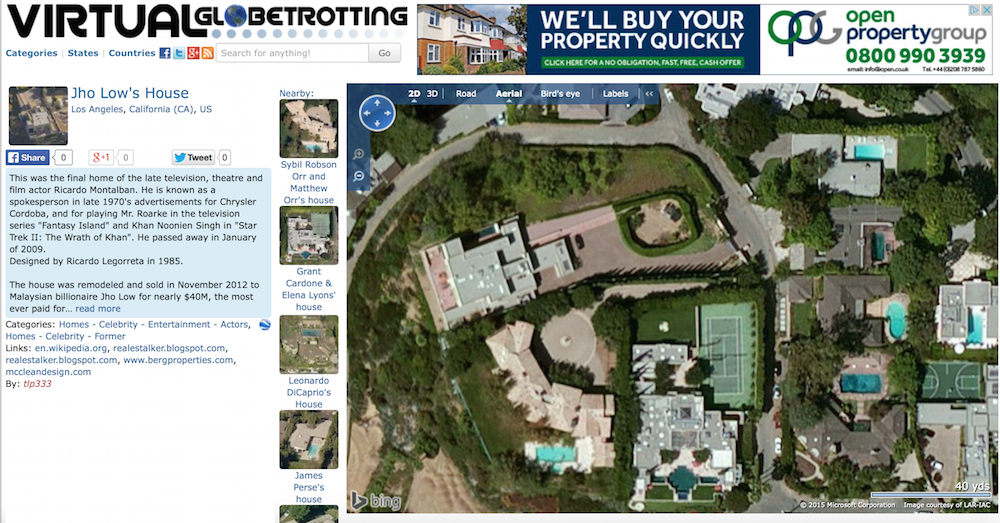

Jho Low himself has meanwhile embarked on a career as one of the world’s richest and most flamboyant youthful tycoons.

Research by Sarawak Report indicates that in 2012 he has purchased the most expensive ever mansion in Hollywood Hills at 1423 Oriole Drive, for just under $39million, dwarfing the $17.5m he spent on buying a house for his pal, the PM’s step son Riza Aziz.

![xxx]()

$39 million dollar mansion

He is also believed to be the proud owner of one of the world’s largest ocean-going yachts, which is currently bound from Tahiti towards the Far East:

![Jho Low is believed to have taken delivery of Equanimity , the world's 34th biggest yacht in July 2014]()

Jho Low is believed to have taken delivery of Equanimity , the world’s 34th biggest yacht in July 2014

Low’s Cristal Champagne splashing antics have subsequently, of course, become legendary in the gambling and nightclub hotspots in the world. This phenomenon was notably recorded by the world’s gossip columns from late October in 2009, when he first starting catching the attention of the celebrity writers in the United States.

In recent years the youthful ‘billionaire tycoon’ has concentrated on building a name for himself as a philanthropist in the West, stating just last week to Forbes Magazine that “philanthropy is cool…and good for business and good for PR”.

![New look?]()

New look – is Jho Low a Charity Man?

It seems reasonable, therefore, to ask whether Malaysia’s 1MDB development money has been channeled towards pleasure and debauchery, as well as good causes in the West, instead of helping the intended poor of the country from whence the money has come?

NEXT – SEE HOW THE 1MDB “LOAN REPAYMENT” LINKED WITH THE BUY OUT OF OF SARAWAK’S UBG BANK